The Second Largest Bank Collapse In History Just Happened, First Republic Bank FAILS

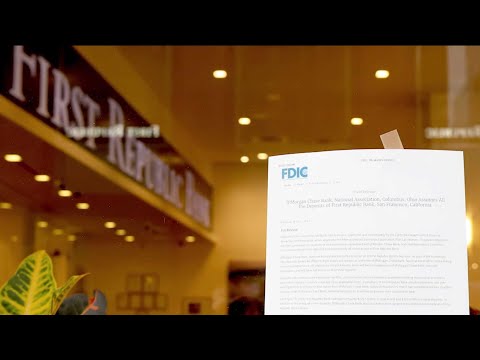

First Republic Bank collapses and it's assets are sold to JP Morgan Chase. Ana Kasparian and Cenk Uygur discuss on The Young Turks. Watch TYT LIVE on weekdays 6-8 pm ET. http://youtube.com/theyoungturks/live Read more HERE: https://www.reuters.com/business/finance/california-financial-regulator-takes-possession-first-republic-bank-2023-05-01/ "Regulators seized First Republic Bank (FRC.N) and sold its assets to JPMorgan Chase & Co (JPM.N) on Monday, in a deal to resolve the largest U.S. bank failure since the 2008 financial crisis and draw a line under a lingering banking turmoil. First Republic was among regional U.S. lenders most battered by a crisis in confidence in the banking sector in March, when depositors fled en masse from smaller banks to giants like JPMorgan as they panicked over the collapse of two other mid-sized U.S. banks."* *** The largest online progressive news show in the world. Hosted by Cenk Uygur and Ana Kasparian. LIVE weekdays 6-8 pm ET. Help support our mission and get perks. Membership protects TYT's independence from corporate ownership and allows us to provide free live shows that speak truth to power for people around the world. See Perks: ? https://www.youtube.com/TheYoungTurks/join SUBSCRIBE on YOUTUBE: ? http://www.youtube.com/subscription_center?add_user=theyoungturks FACEBOOK: ? http://www.facebook.com/TheYoungTurks TWITTER: ? http://www.twitter.com/TheYoungTurks INSTAGRAM: ? http://www.instagram.com/TheYoungTurks TWITCH: ? http://www.twitch.com/tyt ???? Merch: http://shoptyt.com ? Donate: http://www.tyt.com/go ???? Website: https://www.tyt.com ????App: http://www.tyt.com/app ???? Newsletters: https://www.tyt.com/newsletters/ If you want to watch more videos from TYT, consider subscribing to other channels in our network: The Watchlist https://www.youtube.com/watchlisttyt Indisputable with Dr. Rashad Richey https://www.youtube.com/indisputabletyt Unbossed with Nina Turner https://www.youtube.com/unbossedtyt The Damage Report ? https://www.youtube.com/thedamagereport TYT Sports ? https://www.youtube.com/tytsports The Conversation ? https://www.youtube.com/tytconversation Rebel HQ ? https://www.youtube.com/rebelhq TYT Investigates ? https://www.youtube.com/channel/UCwNJt9PYyN1uyw2XhNIQMMA #TYT #TheYoungTurks #BreakingNews 230501__TA03Bank